FRAUD

BY DIRECTORS: LIABILITY & CORPORATE VEIL

The Companies Act 1956 have undergone overhaul and

Companies Act 2013 now is a comprehensive Act entailing details about the

incorporation of a company and procedure for corporate governance and intricacies

related to role and liability of Directors, their fiduciary relationship and

the civil and criminal actions as contemplated within the meaning of the Act

are also illustrated. The company is a juristic entity and can sue or be sued

only by natural person. The Directors have the limited liability, often in

respect of the governance of company and in case of fraud by a company, the

Directors or any officials in Managerial or Supervisory position in the

delinquent company shall also be liable.

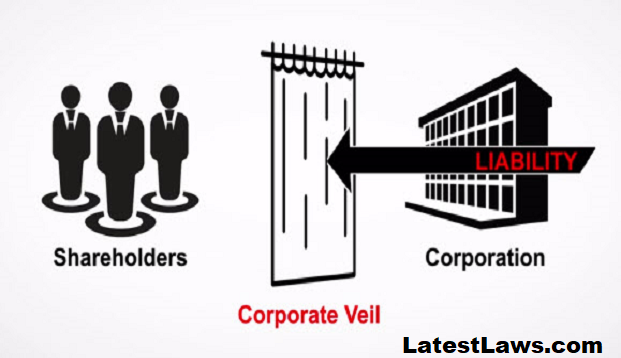

The issue that is faced oftenly by a claimant against the company is the

impediments as regards lifting of

corporate veil of a company and the Directors of a company extricates

themselves from personal liability on the aforesaid premise. What, if fraud is

committed by a Director? Whether the Directors shall be immune to the fraud

committed? How the issues are to be dealt with are the questions that bothers

many.

LAW & PRECEDENTS

In a case reported as Mukesh

Hans & Anr vs Uma Bhasin & Ors 2010Lawsuit/Del 3237 dealt with

the issue of personal guarantee of a Director in a company. The issue was

whether the Directors could be held personally liable in respect of affairs of

a company , if: (i) There is no personal guarantee executed by him (ii) If

there is averment in plaint that the Directors were personally liable and had

undertaken to pay the liability personally and (iii) If there is no personal

undertaking, whatsoever. Another dimension to the case shall be, what if the

debtor company has gone into liquidation? The hon’ble Delhi High Court in the

above referred case has held in para no.11 as under:

11. Indubitably, a company incorporated under the Companies

Act, whether as a private limited company or a public limited company, is a

juristic entity. The decision of the Company are taken by the Board of

Directors of a Company. The Company acts through the Board of Directors, and an

individual Director cannot don the mantle of the Company, by acting on its

behalf, unless he is authorized to act by a special resolution passed by

Board or unless by article of Association so warrants. It is equally well

settled that a Director of a Company, though, he owes a fiduciary duty to the

Company, he owes no contractual duty qua third parties. There are however, two

exceptions to this rule. The first is where the Director or Directors make

themselves personally liable i.e by execution of personal guarantees,

indemnities etc. Secondly, where a Director induces a third party to

act to his detriment by advancing a loan or money to the Company. On the third

party proving such fraudulent misrepresentation, a Director may be held

personally liable to the said third party. It is however well settled that

liability would not flow from a contract, but would flow in an action on tort,

the tort being of misrepresentation and of inducing the third party to act to

his detriment and to part with money”.

A celebrated judgment reported as Salmon

Vs Salmon & Co. Ltd 1897 AC 22 may

be referred to, wherein Lord Macnaghten, observed as under:

The company is at law a

different person altogether from the subscribers to the memorandum and though

it may be that after incorporation the business is precisely the same as it was

before , the same persons are managers, and the same hands receive the profits,

the company is not in law the agent of the subscribers or trustees for them.

Nor are the subscribers as members liable, in any shape or form, except to the

extent and in the manner provided by that Act.

The hon’ble Supreme Court in a case captioned

as New Horizons Ltd vs Union of India

1995 1 SCC 478 has held in para 27 as under:

27. The conclusion would not be different even if the

matter is approached purely from the legal standpoint. It cannot be disputed

that that in law, a company is a legal entity distinct from its members. It was

so laid down by House of Lords in 1897 in the leading case of Salmon Vs Salmon

& Co. Ever since this decision has been followed by the Courts of England

as well as in this country. But there has been inroads in the doctrine of corporate

personality propounded in the said decision by statutory provisions as well by judicial pronouncements. By the process

commonly described as “lifting the veil” , the

law either goes behind the corporate personality to the individual members or

ignores the separate personality of each company in favour of the economic

entity constituted by a group of

associated companies. . This course is adopted when it is found that the

principles of corporate personality is too flagrantly opposed to justice…..”

In a matter reported as Tristar

Consultants Vs Customer Service India Pvt Ltd & anr 2007 139 DLT

688, the Delhi High Court has held as under in paragraph no.28:

“To

interpret the law as is sought to be projected by the petitioner would mean

negation of the concept of a company being limited by its liability as per the

memorandum and article of association of the Company. Other then where

Directors are have made themselves personally liable i.e by way of guarantee,

indemnity etc. liabilities of directors of a company, under common law are

confined to cases of malfeasance and misfeasance i.e where they have been

guilty of tort towards those to whom they owe a duty of care i.e discharge

fiduciary obligations. Admittedly qua third parties, where Directors have

committed tort. To the third party, they may be personally liable”.

The hon’ble Delhi High Court has

held in Mukesh Hans (Supra) that if

there is assertion in plaint that the Directors had extended any contract of

guarantee or had undertaken to make payment to the respondents of the loan

amount on behalf of the company or owed liability in any manner then only the

Directors could be held to be liable. Moreover, a mere assertion of fraud shall

be meaningless, unless, the same is pleaded meticulously and in detail to the

hilt. As per Order VI Rule 4 of Code of Civil Procedure, the particulars of

fraud should be clearly stated in plaint with particulars.

In the above backdrop, it may be

worthwhile to refer to a judgment rendered by hon’ble Supreme Court in a case

reported as Raj Saluja Vs Air India Ltd (2014) 9 SCC 408:

“ 71. Thus, on relying upon the

aforesaid decisions, the doctrine of piercing the veil allows the Court to

disregard the separate legal personality of a company and impose liability upon

the persons exercising real control over the said company. However, this

principle have been and should be applied in a restrictive manner, that is,

only in a scenarios wherein it is evident that the company was a mere

camouflage or sham deliberately created by the persons exercising control over

the said company for the purpose of avoiding liability. The intent of piercing

of veil must be such that would seek to remedy a wrong done by the persons

controlling the company. The application would thus depend upon the peculiar

facts and circumstances of each case”.

The Supreme Court has held in Arcelormittal India Pvt Ltd vs Satish Kumar

Gupta & Ors (2019) 2 SCC 1 has

held as under:

“37. It is thus clear that,

where a statute itself lifts the

corporate veil, or where protection of public interest is of paramount

importance, or where the company has been found to evade obligations imposed by

the law, the court will disregard the corporate veil. Further his principle is

applied even to group companies, so that one is able to look at the economic

entity of the group as a whole”.

CONCLUSION

The aforesaid discussion based on

the judgments rendered by hon’ble Supreme Court and hon’ble Delhi High Court has

laid down that salmon case (Supra) cannot be applied holistically and in all

situations and in all circumstances and that law has evolved ever since. The

Salmon case is a benchmark, alright, and lifting of corporate veil is generally

not recommended , but in the case of public interest, camouflage, deception and

fraud, Salmon (Supra) shall not aid the delinquent. The personal guarantee,

apart, if fraud is inbuilt in a suit or petition and averments with specific particulars

to that effect are found conspicuous in such plaint or petition, then, in such

a situation protective umbrella of Salmon

(Supra) shall not be available to such Directors and the Directors could be

held liable. Moreover, when the plaint with specific lists of the acts

attributed on Directors and his personal liability by virtue of such documents

or undertaking are part of record, the Directors cannot claim immunity. The

situation has changed and quite vastly taking note of overall good and public

interest. The deception and deceit have also acquired new dimension and blanket

ban to prosecution of individual Director on the premise of no individual liability

shall not hold good in every case and if a closely held company is created for an

outlet of sham transaction and the debtor is sought to be defrauded, then, Salmon (Supra) shall not aid such Director.

Moreover, even when lack of contract or lack of privity may help a Director

from evading personal liability, law of tort and malfeasance and misfeasance

may still catches with them if the acts of fraud and deceit are evident.

______

Anil K Khaware

Founder & Senior Associate

Societylawandjustice.com

No comments:

Post a Comment