CIBIL: WRONGFUL LISTING AND LEGAL REMEDY

In

a modern world commercial and other transactions, availing of loan and issues

related to credit are inevitable. However, there may be default in repayment of

loan and consequence shall follow. In case of delay in loan repayment , in

India the publication of name in the CIBIL (Credit Information Bureau (India)

Ltd) website as a willful defaulter may be the consequence. The same is done on

the basis of information supplied by the lender bank or Financial Institution

and it is in turn forwarded by the Reserve Bank of India (RBI) to the CIBIL for

publication in the website. This has ramification, in fact, far reaching at

that.

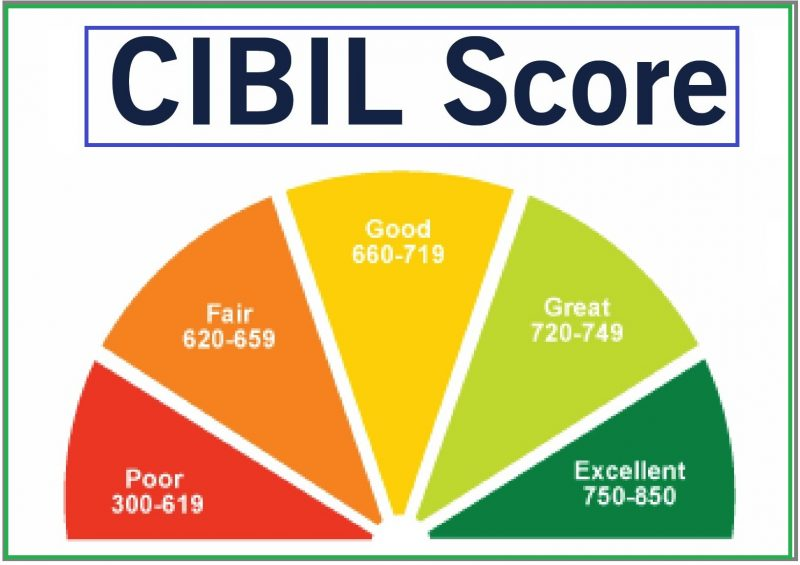

Once there is a negative CIBL score, applicant for

loan, if approaches bank or financial institutions and if the name of such

applicant feature in the CIBIL website maintained by the on behalf of the

Reserve Bank of India as a "willful defaulter" the finances could be

denied to such loan seekers.

The Reserve Bank of India directions by way of various

circulars issued from time to time stipulates opportunity of being heard to

alleged defaulter , before including the defaulter in the list of willful

defaulters to be forwarded to the Reserve Bank of India by the lender bank in

accordance with the circulars. If the applicant is not accorded opportunity of

hearing or not even informed about any proceedings by the Bank to forward his

name to the Reserve Bank of India as a willful defaulter, such featuring of

name in CIBIL website may be bad in law. As per RBI Guideline a committee consisting

of three GMs/DGMs or equivalent to GMs/DGMs for identifying the cases of willful

defaulters should be also constituted to identify willful defaulter for onward

publishing of name on CIBIL website.

The Supreme Court in State of Orissa & Ors Vs Md

Illiyas, AIR 2006 SC 258 has held that merely because a person commits

default in doing a thing that default does not become willful, unless it is

intentional, conscious and deliberate.

MAINTAINABILITY OF A WRIT PETITION

This is no more res integra that a writ petition under Article 226 of the Constitution of India may be maintainable

against

(i) the

State (Government);

(ii) an authority;

(iii) a statutory body;

(iv) an instrumentality or agency of the State;

(v) a company which is financed and owned by the

State;

(vi) a private body run substantially on State

funding;

(vii) a private body discharging public duty or

positive obligation of public nature; and

(viii) a person or a body under liability to

discharge any function under any statute, to compel it to perform such a

statutory function."

Of course, a writ petition shall

lie against State or state instrumentality and also against a bank for any wrongful

action on their part. The reference in this regard may be have to Federal

Bank Vs Sagar Thomas & Ors (2003) 10 SCC 733. However, the Supreme

Court in Canara Bnak Vs P.R.N Upadhyay & Ors [(1998) 6 SCC 526], and

Kerala High Court Division Bench in Suter Paul Vs Sobhana English Medium School

(2003 (3) KLT 1019, Academy of Medical Sciences v. Regine, (2004

(3) KLT 628) as also a decision of a Single Judge in Abdul

Azeez Vs Alappuzha Bar Association (1992

(2) KLT 443), it is held that even a private party discharging a public

duty or a positive obligation of a public nature or a person or a body under a

liability to discharge any function under any statute to compel it to perform

such statutory function, a writ petition under Article 226 of the Constitution

of India against such private body shall be maintainable. Thus performing an

obligation an obligation cast on it by the Reserve Bank of India by a circular,

which itself has been issued in exercise of the powers of the Reserve Bank of

India under Section 35 A of the Banking Regulation Act, 1949 and is statutory

in nature. That being so, in the matter of classification of the petitioner as

a willful defaulter, the lender bank was performing a statutory duty cast upon

them by the Reserve Bank of India, in respect of which certainly a writ

petition would lie under Article 226 of the Constitution of India.

The CIBIL website often claims in

a matter of such nature that they have no responsibility for the contents of

the website in so far as their role is only to collect correct information

given by various Banks/Financial Institutions, assemble it and publish in the

website in accordance with the directions of the Reserve Bank of India. They

cannot be held responsible for the contents of the website.

The powers of

the High Court under Article 226 of Constitution of India has been illustrated

in several de decisions. In Andi Mukta Sadguru Shree Muktajee Vandas

Swami Suyarma Jayanti Mahotsav Smarak Trust Vs V.R Rudani & Ors, AIR 1989

SC 1607, Supreme Court held thus:

"Article

226 confers wide powers on the High Courts to issue writs in the nature of

prerogative writs. This is a striking departure from the English law. Under

Article 226 writs can be issued to "any person or authority". It can

be issued for the enforcement of any of the fundamental rights and for any

other purpose."

It was further observed by their

Lordships as hereunder:

"The term 'authority' used in Article 226 in

the context, must receive a liberal meaning unlike the term in Article

12.Article is relevant only for the purpose of enforcement of fundamental

rights under Article 226 confers powers on the High Courts to issue writs for

enforcement of the fundamental rights as well as non- fundamental rights. The

words "any person or authority" used in Article 226 are, therefore,

not to be confined only to statutory authorities and instrumentalities of the

State. They may cover any other person or body performing public duty. The form

of the body concerned is not very much relevant. What is relevant is the nature

of the duty imposed on the body. They duty must be judged in the light of

positive obligation owned by the person or authority to the affected party. No

matter by what means the duty is imposed. If a positive obligation exists

mandamus cannot be denied"."

The Supreme Court has in Canara Bank (supra) has

held that circulars issued by the Reserve Bank of India under Section 21 or 35

of the Banking Regulation Act 1949 are

statutory in nature and are required to be complied with by the Banks. Although

what is referred to therein is Section 35, it is clear that the same refers to

Section 35 A only, since Section 35 deals with inspections and it is Section 35

A which deals with the powers of the Reserve Bank to issue directions. That

being so, the circular has been issued in exercise of a statutory function of

the Reserve Bank of India, which itself is statutory in nature. In exercise of

that statutory function only, the lender bank is obliged to or empowered to

classify and forward to the Reserve Bank of India, the names of borrowers of

willful defaulters. The lender bank, under no provision of law, has a right or

power to do the same on their own. Therefore, in the matter of classification

of a customer as a willful defaulter, the lender bank, even if a private bank

is essentially exercising a statutory function as required by the Reserve Bank

of India in exercise of their statutory function under Section 35-A of the

Banking Regulation Act. Therefore, though if a bank could be a private body discharging a public duty or

positive obligation of public nature and discharging a statutory function

as directed by the Reserve Bank of

India, thus, a writ petition under Article 226 of the Constitution of India

shall lie.

Willful Defaulter

"Willful

default will broadly cover the following:

a) Deliberate non-payment of the dues despite

adequate cash flow and good networth.

b) Siphoning off of funds to the detriment of the

defaulting Unit.

c) Assets financed have either not been purchased

or have been sold and proceeds have been misutilised.

d) Misrepresentation/falsification of records.

e) Disposal/removal of securities without bank's

knowledge.

f) Fraudulent transactions by the borrower.

The identification of the wilful

default should be made keeping in view the tract record of the borrowers and

should not be decided on the basis of isolated transactions/incidents. The

default to be categorised as wilful must be intentional, deliberate and

calculated."

From a very reading of the said clause, it is

abundantly clear that an objective adjudication as to whether a person is a

willful defaulter or not is contemplated by the circular of RBI itself The

lender bank is expected to decide not only as to whether the loan defaulter is

a defaulter, but whether the default can

be categorised as willful, intentional, deliberate and calculated. That being

so, the very scheme of circular contemplates a notice and hearing to the person

who is sought to be classified as a willful defaulter, without which an

objective decision on the same is not possible and is not desirable also. The Ruia

Cotex (Supra) has held on similar line.

BANKING REGULATION ACT 1949

The Section 35- A of the Banking Regulation Act reads thus:

"35A. Power of the Reserve Bank

to give directions:

(1)

Where the Reserve Bank is satisfied that--

(a)

in the public interest; or (aa) in the interest of banking policy; or

(b)

to prevent the affairs of any banking company being conducted in a manner detrimental

to the interests of the depositors or in a manner prejudicial to the interests

of the banking company; or

(c)

to secure the proper management of any banking company generally, it is

necessary to issue directions to banking companies generally or to any banking

company in particular, it may, from time to time, issue such directions as it

deems fit, and the banking companies or the banking company, as the case may

be, shall be bound to comply with such directions.

(2)

The Reserve Bank may, on representation made to it or on its own motion, modify or cancel any

direction issued under sub-section (1), and in so modifying or cancelling any

direction may impose such conditions as it thinks fit, subject to which the

modification or cancellation shall have effect.

ADHERENCE TO PRINCIPLES OF NATURAL JUSTICE

If an applicant for loan is aggrieved by the wrongful featuring of his name or wrongful retention of his name by CIBIL at the instance of lender , the appropriate remedy shall be to prefer a writ petition in a concerned High Court. The writ petition may be of a nature of writ of mandamus or other appropriate writ.

The High Court of Calcutta in a matter captioned as Ruia Cotex Ltd Vs Corporation Bank & Ors AIR 2007 Calcutta 241,has held that right to an opportunity of being heard to the defaulter is inherent in the circular of the Reserve Bank of India for the purpose of classifying a person as a willful defaulter, even though there may not be express provision in the earlier circular, though, in a circular post 2014, such provisions are clearly there.

The Kerala High Court in a matter captioned as Kurien

E. Kalathil vs Credit Information Bureau W. P (C) No. 32370 of 2007 has also made it

clear that though the listing in the CIBIL negative list may emanate from RBI

circular, but the willful defaulter is named by a lender bank and therefore it

cannot be said that willful defaulter is declared by RBI and not be lender bank

and therefore it cannot be pleaded that lender bank cannot have a role in it. It

is so, because the Bank is to convince the RBI in the first instance that the

alleged defaulter has violated the provision of the circular/guidelines issued

by the RBI. The

circular dated 29-7-2003 by the RBI stipulates that the application should

clearly provides that recommendation be well documented and supported by

requisites evidence. It thus entail that Bank should be cautious in

recommending the name. As penal action will follow thereafter, the rule of natural justice will come into

play and it is expected that an opportunity should have been given to the person

concerned whose interest is going to be prejudiced.

In C.B Gautam Vs Union of India

& Ors (1993) 1 SCC 78, the Supreme Court has held that opportunity

of showing cause even if the same is not supported in the statute must be

afforded by way of compliance with immediate requirement of natural justice

rule where provision involved adverse civil consequences.

In Southern Painters Vs Fertilizers

& Chemicals Travancore Ltd & Ors (1994) Supple (2) SCC 699: AIR

1994 SC 1277), the Supreme Court held that an opportunity of being heard should

be given on the basis of rule of natural justice.

In M/s Frustan Equipments &

Chemicals Ltd Vs State of West Bengal & Anr (1975) 1 SCC 70 and in Union of India & Ors Vs A.K Mithiborwala

& ors (AIR 1975 SC 266), the Apex Court has held that eve a party, who

is black listed is entitled to a notice

to be heard before his name is put on the black list.

In Canara Bank Vs Debasis Das &

Ors (2003) 4 SCC 557: (AIR 2003 SC 204) it is held that natural justice

–Audit Alteram partem must precede

any adverse order.

What thus follows is that the

very publication of name in the website as a willful defaulter is sufficient to

hold that it would injure him, especially, if the defaulter is a businessman,

who has to approach banks for the purpose of finance and after learning that he

is a willful defaulter to another Bank, no banker would advance money to such

alleged defaulter.

It is thus clear on the basis of

above that as per the settled proposition of law , where the interest of a

person is going to be prejudiced by some act of another person, the person,

whose interest is affected is entitled to get an opportunity of being heard

before any substantive decision is taken."

STATE CONSUMER

COMMISSION

The State Consumer Disputes Redressal

Commission, Hyderabad in a matter captioned as Ms. Anjoo Sharma vs (Hsbc Bank),

Hyderbad CC No. 15/2009 has dealt with default in credit card issue and

consequent negative listing of complainant in CIBIL website. The bank had asserted

that the rules of Reserve Bank of India (RBI) mandates information to CIBIL

whenever a customer commits default. Accordingly it had furnished information

to the concerned agency. It was discharging its statutory obligation. It

justified that the information that was sent was correct. It was complainants

negligence in non-payment of amounts in time resulted in reporting the matter

to CIBIL. The complainant, according to the bank had to approach CIBIL to get

her name deleted from the black list and it had no concern whatsoever for

getting her name removed from the said agency.

It was further contended that every customer who had failed to discharge the

amounts within 90 days, his account would be classified as Non Performing Asset

(NPA) and immediately the above said agencies shall have to be informed. Since

the alleged defaulter had committed default her statement was sent to CIBIL and

therefore it cannot be said that there was deficiency in service or violation

of rules of RBI. Even otherwise, owing to non-payment of dues for more than 180

days, the card account was termed as a Non-Performing Asset and the same has

been updated to CIBIL as directed by RBI.

The State Commission had rejected the

contentions of the bank. It is held that the bank is duty bound to inform the

customers for adhering to 90 days period. The bank could not have waited if the

complainant had committed default. The claim of the bank that it is the CIBIL,

that had classified the complainant as international financial offender and the

bank had no control over CIBIL and all such contention are contrary to the RBI

guidelines. The bank is mandated to issue notice directing the complainant to

pay the dues nor addressed a letter stating that the information would be sent

to CIBIL in order to classify her an international financial offender. The bank

had undoubtedly flouted the RBI rules. The RBI had to take up this matter

suo-moto and impose penalty against the bank for violation of guidelines

invoking rules issued by it.

It is further held that the bank had

evidently damaged the reputation of the complainant knowing full well that if once

her name is registered in the black list of CIBIL the customer would be dubbed

as defaulter and international offender It was not a simple issue that could be

ignored. The complainant is admittedly doing business. Her creditworthiness

would be at stake which is bread and butter for anybody to do business.

Considering the fact that the bank had violated all norms in recommending the

name of the complainant to CIBIL and utterly failed to get it corrected despite

the fact that the bank had admitted that it was a mistake, amounting to clear

deficiency in service and liable to pay compensation. The bank was therefore

directed to pay to the complainant a sum of Rs 20,00,000/- towards

compensation.

The ld State Commission had also repelled the contention of the bank

that a Consumer Commission shall have no jurisdiction to entertain the matter

as services under the credit cards would not attract the definition u/s 2(1)(o)

of the Consumer Protection Act. It is held that Credit cards are basically

given for attending to the personal financial needs by using the same instead

of payment in cash and for personal use. In fact their services are included in

the definition and therefore it was held that the State Commission has

jurisdiction to redress her grievance of the complainant.

R E M A R K

The aforesaid

discussion shall clearly entail that there are well set out parameter before

listing the name of alleged defaulter on CIBIL website and in whimsical or

fanciful manner no names could be included on CIBIL website . Principles of

natural justice entailing opportunity of being heard shall be the essence

before forwarding the name of alleged defaulter to RBI and for onward listing

on CIBIL website. Any wrongful naming based on omission or commission or

negligence on the part of lender bank or agency/agencies may lead to

deprivation and may cause immense harm to the personal integrity of a person,

therefore safeguard as per law is prescribed. However, there are instances, quite

large at that, when without following due process of law the name of individual/entity

is forwarded to the CIBIL for onward listing of names as defaulter. The complainant

in that event shall have to approach courts of law for no fault of theirs. The

authority concern, therefore, should be vigilant so that scrupulous cases may

not be listed on CIBIL website. The carefully crafted filtering process in the

first instance should therefore be the norm. In the event of mechanical recommendation

of names as loan defaulter for onward listing on CIBIL website, the delinquent

person should be meted out exemplary deterring punishment.

------------

Anil

K Khaware

Founder

& Senior Associate

Societylawandjustice.com

No comments:

Post a Comment